Update on the Overtime Rule

By Frank Del Barto

On Monday, October 30, 2017, the U.S. Department of Labor ("DOL") announced plans "to undertake new rulemaking with regard to overtime." As discussed in our Annual Seminar, the DOL published a Request for Information ("RFI") seeking comment on a new overtime rule on July 26, 2017. The RFI sought feedback from interested stakeholders on the salary level amount, "the duties test, inclusion of non-discretionary bonuses and incentive payments to satisfy a portion of the salary level, the salary test for highly compensated employees, and automatic updating of the salary level tests." Based on the DOL's announcement last week, we fully expect the DOL to issue a proposed rule and a final rule in 2018. As discussed in our annual seminar, we expect that the current salary level for exempt status ($23,660) will increase to a salary level in the low $30,000 range.

The Employer did not Violate the FMLA or the ADA When it Refused to Extend an FMLA Leave for Three Additional Months and Terminated the Employee The Day Before Surgery

By Nancy E. Sasamoto

Raymond Severson took a 12-week medical leave under the Family and Medical Leave Act ("FMLA") due to serious back pain. On the last day of his leave, he underwent surgery that would require him to remain off of work for two to three more months. His employer, Heartland Woodcraft, Inc. ("Heartland") denied his request for an extension and terminated his employment the day before his surgery, but told him he could reapply when he was cleared to work. Severson did not reapply, but instead sued Heartland alleging that it violated the Americans with Disabilities Act ("ADA") by failing to provide a reasonable accommodation. The Seventh Circuit Court of Appeals held that a multi-month leave of absence is not a reasonable accommodation and affirmed the dismissal of the case.

The Court stated that the ADA is an antidiscrimination statute, not one that entitles employees to a leave of absence, like the FMLA. The ADA protects "a qualified individual" with a disability who "with or without reasonable accommodation, can perform the essential functions of the job. The term "reasonable accommodation" means measures that will enable the employee to work. An employee who needs a long-term medical leave cannot work and thus, is not a "qualified individual" under the ADA.

In this case, there was no question that Severson had a disability and that he was unable to frequently lift 50 pounds or more, which was an essential function of the position. The Court rejected Severson's argument that Heartland should have accommodated him by (1) granting a multi-month leave after his FMLA had expired, (2) reassigning him to a vacant job, or (3) temporarily assigning him to a light-duty position that did not require heavy lifting. First, the Court held that an extended leave does not help an employee perform the essential functions of the position; it excuses his not working. In an earlier decision, the Court had left open the question of whether a short extension of a leave could be a reasonable accommodation.

As to the other two arguments, Severson failed to prove that there was a vacant job available at the time he was terminated. Finally, the Court held that an employer is not required to create a light duty position or assign light-duty work if it does not have a policy of providing light duty work to employees who suffered work-related injuries, which Heartland did not have.

Many employers will reluctantly grant extended leaves of absence to employees, who have exhausted FMLA leave, without undertaking the analysis of whether they can reasonably accommodate such an extended leave. The Seventh Circuit has left open the question of when an extension of a leave is a reasonable accommodation under the ADA, but provides some guidance for employers in the Severson decision.

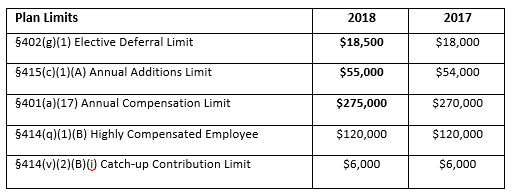

New Retirement Plan Limitations for 2018

By Frank Del Barto

Recently, the Internal Revenue Service ("IRS") announced the cost-of-living adjustments affecting the dollar limitations for retirement plans for tax year 2018. At this time, we recommend that every plan sponsor conduct a "mini-audit" of their 401(k) plan to ensure that the proper plan limits are being utilized and that the plan is being administered in accordance with the plan documents, especially related to the plan's definition of compensation. The new plan dollar limits are:

For more information about this or any other employment law topic, please contact Frank Del Barto, Chair of the Employment, Labor & Benefits Group, at 847.734.8811 or via email at fdelbarto@masudafunai.com.